Chapter 4: Consumer Surplus, Producer Surplus and Economic Efficiency

Using the demand and supply model, we can assess how changes in market prices impact the benefits from trade. Because economists use these benefits as a measure of social welfare and economic efficiency, we can also determine how various government policies influence social welfare and economic efficiency.

Consumer surplus is the difference between what you are willing and able to pay for a good and the price that you actually pay for the good.

Consumer surplus can also be viewed as the net benefit you receive from obtaining a good or service, since it is the difference between the benefit you receive from a good, measured as your willingness to pay for the good, and the price you pay for the good.

We can use the demand curve to illustrate consumer surplus. The "vertical" interpretation of a demand relationship describes the maximum amount that consumers are willing and able to pay to obtain a given amount of a good.

The sum of the consumer surplus obtained by the buyers and the producer surplus obtained by the sellers is the economic surplus obtained from the transaction.

Producer surplus is the difference between the price at which a seller is willing and able to sell a good and the price that he or she actually receives for the good.

Like consumer surplus, producer surplus can be viewed as the net benefit sellers earn from selling a good or service, since it is the difference between the benefit they receive (the revenue they earn from the sale) and the cost of producing and selling the good.

The sum of the consumer surplus obtained by the buyers and the producer surplus obtained by the sellers is the economic surplus obtained from the transaction.

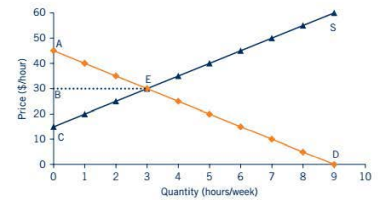

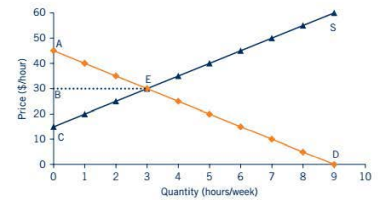

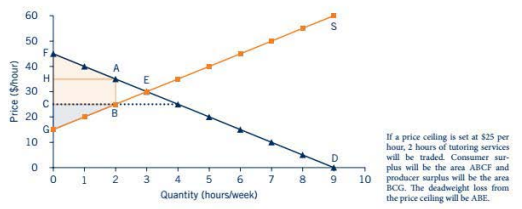

Here for an example, the market for tutoring services. The equilibrium price is $30 per hour and the equilibrium quantity is 3 hours per week, shown at point E. At equilibrium, consumer surplus is the triangle ABE ($22.50 per week), and producer surplus is the triangle CBE ($22.50 per week). The economic surplus is the triangle ACE, equal to $45 per week. The economic surplus tells us that the buyers and sellers in this market are better off by $45 than they would have been if the trade had not taken place.

At equilibrium, marginal benefits are equal to marginal costs, so that equilibrium generates economic efficiency, the highest possible economic surplus, and the maximum social welfare possible from the market.

The reduction in economic surplus that results from disequilibrium outcomes is called deadweight loss. Deadweight loss represents the decrease in economic welfare or economic surplus that results from disequilibrium market outcomes.

Restrictions that place an upper limit on the price that can be charged for a good or service are called price ceilings.

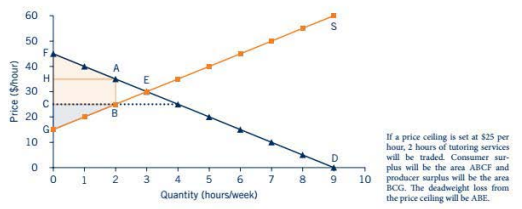

For example, the market is in equilibrium, the price of tutoring is $30 per hour and 3 tutoring hours are sold per week. At this equilibrium, economic surplus is $45.

Now suppose that some students protest that the $30 per hour rate for tutoring is too expensive.

As a result, the administrators impose a price ceiling on tutoring services, limiting the maximum price that can be charged to $25 per hour.

At this price, quantity supplied is 2 hours per week and quantity demanded is 4 hours per week.

Because quantity demanded is greater than quantity supplied, a market shortage of tutoring results, and we would expect to see wait lists for tutoring.

Price floors place a lower limit on the price of a good or service by establishing a minimum price that can be charged for a good or service.

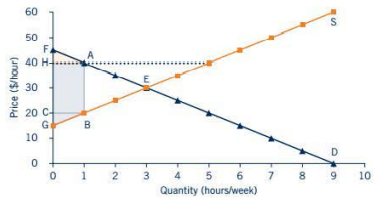

Suppose a price floor is set at $40 per hour. At that price, quantity supplied is 5 hours per week and quantity demanded is 1 hour per week.

This generates a market surplus of tutoring services of 4 hours per week.

Consumer surplus will now be the triangle AFH, and producer surplus will be the area of the triangle BGC plus the rectangle ABCH. The price floor will generate a deadweight loss equal to the triangle AEB.

A quota is used to restrict the production of goods and services or to limit the amount of imports of goods allowed into a country.

We use the concept of economic surplus to help us assess who bears the costs or reaps the benefits of government restrictions on market activities. Because restrictions on market activity generate deadweight losses and tend to benefit some groups at the expense of others, they are highly controversial.

Chapter 4: Consumer Surplus, Producer Surplus and Economic Efficiency

Using the demand and supply model, we can assess how changes in market prices impact the benefits from trade. Because economists use these benefits as a measure of social welfare and economic efficiency, we can also determine how various government policies influence social welfare and economic efficiency.

Consumer surplus is the difference between what you are willing and able to pay for a good and the price that you actually pay for the good.

Consumer surplus can also be viewed as the net benefit you receive from obtaining a good or service, since it is the difference between the benefit you receive from a good, measured as your willingness to pay for the good, and the price you pay for the good.

We can use the demand curve to illustrate consumer surplus. The "vertical" interpretation of a demand relationship describes the maximum amount that consumers are willing and able to pay to obtain a given amount of a good.

The sum of the consumer surplus obtained by the buyers and the producer surplus obtained by the sellers is the economic surplus obtained from the transaction.

Producer surplus is the difference between the price at which a seller is willing and able to sell a good and the price that he or she actually receives for the good.

Like consumer surplus, producer surplus can be viewed as the net benefit sellers earn from selling a good or service, since it is the difference between the benefit they receive (the revenue they earn from the sale) and the cost of producing and selling the good.

The sum of the consumer surplus obtained by the buyers and the producer surplus obtained by the sellers is the economic surplus obtained from the transaction.

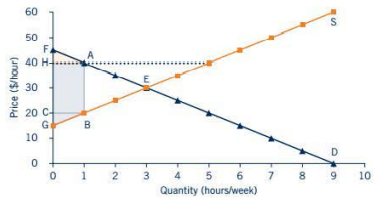

Here for an example, the market for tutoring services. The equilibrium price is $30 per hour and the equilibrium quantity is 3 hours per week, shown at point E. At equilibrium, consumer surplus is the triangle ABE ($22.50 per week), and producer surplus is the triangle CBE ($22.50 per week). The economic surplus is the triangle ACE, equal to $45 per week. The economic surplus tells us that the buyers and sellers in this market are better off by $45 than they would have been if the trade had not taken place.

At equilibrium, marginal benefits are equal to marginal costs, so that equilibrium generates economic efficiency, the highest possible economic surplus, and the maximum social welfare possible from the market.

The reduction in economic surplus that results from disequilibrium outcomes is called deadweight loss. Deadweight loss represents the decrease in economic welfare or economic surplus that results from disequilibrium market outcomes.

Restrictions that place an upper limit on the price that can be charged for a good or service are called price ceilings.

For example, the market is in equilibrium, the price of tutoring is $30 per hour and 3 tutoring hours are sold per week. At this equilibrium, economic surplus is $45.

Now suppose that some students protest that the $30 per hour rate for tutoring is too expensive.

As a result, the administrators impose a price ceiling on tutoring services, limiting the maximum price that can be charged to $25 per hour.

At this price, quantity supplied is 2 hours per week and quantity demanded is 4 hours per week.

Because quantity demanded is greater than quantity supplied, a market shortage of tutoring results, and we would expect to see wait lists for tutoring.

Price floors place a lower limit on the price of a good or service by establishing a minimum price that can be charged for a good or service.

Suppose a price floor is set at $40 per hour. At that price, quantity supplied is 5 hours per week and quantity demanded is 1 hour per week.

This generates a market surplus of tutoring services of 4 hours per week.

Consumer surplus will now be the triangle AFH, and producer surplus will be the area of the triangle BGC plus the rectangle ABCH. The price floor will generate a deadweight loss equal to the triangle AEB.

A quota is used to restrict the production of goods and services or to limit the amount of imports of goods allowed into a country.

We use the concept of economic surplus to help us assess who bears the costs or reaps the benefits of government restrictions on market activities. Because restrictions on market activity generate deadweight losses and tend to benefit some groups at the expense of others, they are highly controversial.

Knowt

Knowt