Chapter 11: Monopolistic Competition and Oligopoly

Monopolistic competition - Relatively large number of sellers, differentiated products, easy entry/exit

Relatively large # of sellers

Small market shares

No collusion - The presence of a relatively large number of firms ensures that collusion by a group of firms to restrict output and set prices is unlikely

Independent action - Each firm can determine its own pricing policy without considering the possible reactions of rival firms

Product differentiation - Variations of particular product

Product attributes

Service

Location

Brand names + packaging

Some control over product prices

Easy entry + exit

Few economies of scale

Low capital requirements

Non-price competition - Product differentiation + advertising

Four firm concentration ratio - Ratio of the output (sales) of the four largest firms in an industry relative to total industry sales

Very low in purely competitive industries

Herfindahl index - Sum of the squared percentage market shares of all firms in the industry

Important to assess oligopolistic industries

Lower index → Greater chance of being competitive

Monopolistic competition’s demand curve

Highly elastic

No perfect product substitutes

Price elasticity depends on # of rivals + degree of product differentiation

Short run

Produces where MR = MC

May incur loss in short run

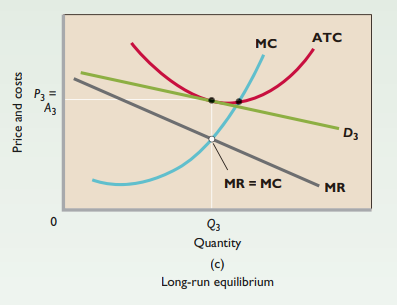

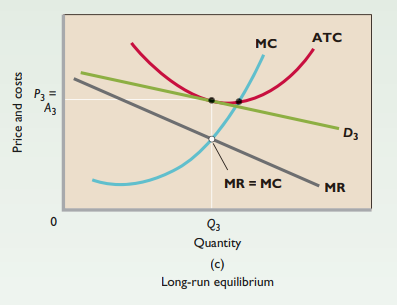

Long run

Only normal profit (break even)

Economic profits → Firms enter industry → Quantity increases → Economic profit decreases

Economic losses → Firms leave industry → Quantity decreases → Economic profit increases

Complications

Product differentiation can prevent duplication

In reality, entry is not as free

Efficiency

Neither productive nor allocative efficiency

Average total cost slightly higher than optimal

P > MC → Underallocation of resources

Excess capacity - Plant and equipment that are underused because firms are producing less than the minimum-ATC output

Product differentiation

Stay ahead of competitors

Provides more range to consumers

Trade-off b/w consumer choice + productive efficiency

Oligopoly - Market dominated by a few large producers of a homogeneous or differentiated product

3-5 firms

Homogeneous oligopoly - Standardized products

Differentiated oligopoly - Differentiated products

Strategic behavior - Self-interested behavior that takes into account reactions of others

Mutual interdependence - A situation in which each firm’s profit depends not entirely on its own price and sales strategies but also on those of the other firms

Entry barriers

Economies of scale

Large capital expenditures

Ownership + control of raw resources

Merge 2 competing firms → Increase market share + achieve greater economies of scale + greater monopoly power

Shortcomings of concentration ratios

Localized markets

Interindustry competition - Competition b/w 2 products associated w/ different industries

Import competition - Competition b/w foreign products

Game theory - Study of how people behave in strategic situations

Payoff matrix shows payoff to each firm resulting from different combinations of strategies

Collusion - Cooperation w/ rivals rather than work competitively/independently

Incentive to cheat - Cheating on collusive agreement to increase own profit

3 oligopoly models

(1) the kinked-demand curve, (2) collusive pricing, and (3) price leadership

Why isn’t there only a single model?

Diversity of oligopolies - Oligopoly encompasses a greater range and diversity of market situations than do other market structures

Complications of interdependence - The mutual interdependence of oligopolistic firms complicates matters significantly

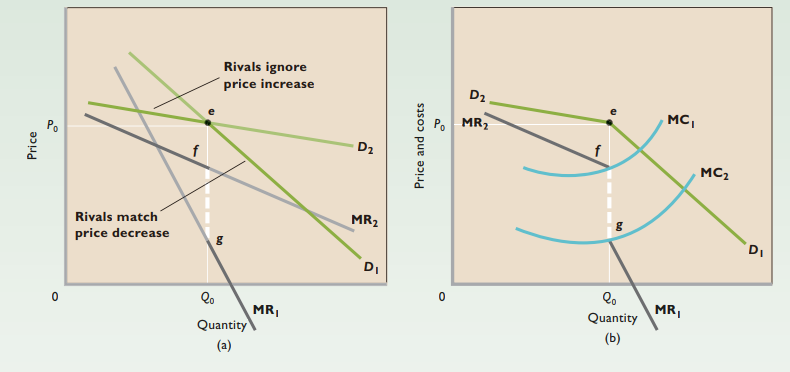

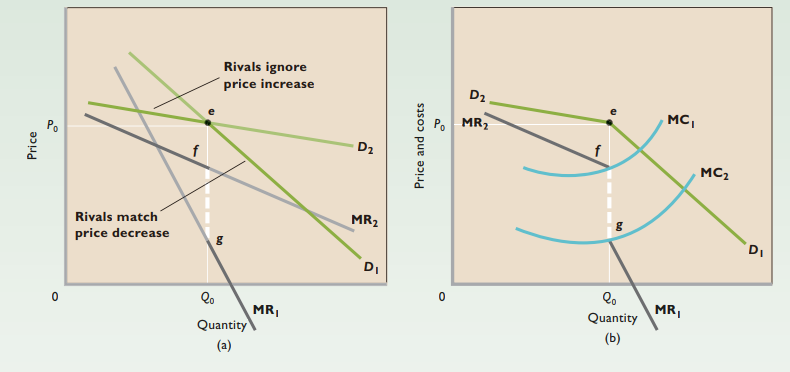

Kinked demand curve - Demand is highly elastic above the going price P0 but much less elastic or even inelastic below that price

Rivals can either match price changes or ignore price changes

Prices stable in non-collusive oligopolistic industries

Even if costs change significantly, may not need to change price

Price war - Successive and continuous rounds of price cuts by rivals as they attempt to maintain their market shares

Cartels + other collusion

Cartel - A group of producers that typically creates a formal written agreement specifying how much each member will produce and charge

Obstacles to collusion

Demand + cost differences - When oligopolists face different costs and demand curves, it is difficult for them to agree on a price

Number of firms - Other things equal, the larger the number of firms, the more difficult it is to create a cartel or some other form of price collusion

Cheating - Collusive oligopolists are tempted to engage in secret price cutting to increase sales and profit

Long-lasting recession - Slumping markets increase average total cost

Potential entry of new firms - The greater prices and profits that result from collusion may attract new entrants, including foreign firms

Anti-trust law - U.S. antitrust laws prohibit cartels and price-fixing collusion

Price leadership - The dominant firm initiates price changes and all other firms more or less automatically follow the leader

Infrequent price changes

Communications of price changes

Limit pricing

Oligopoly + advertising

Product development + advertising less easily duplicated than price cuts

Positive effects

Diminishes monopoly power

Lowers consumers’ search costs

More economic efficiency

Negative effects

No info about price or quality

Based on misleading claims

Establishes brand loyalty + monopoly power

Oligopoly + efficiency

Neither productive nor allocative efficiency

No regulation of loophole monopoly power

Chapter 11: Monopolistic Competition and Oligopoly

Monopolistic competition - Relatively large number of sellers, differentiated products, easy entry/exit

Relatively large # of sellers

Small market shares

No collusion - The presence of a relatively large number of firms ensures that collusion by a group of firms to restrict output and set prices is unlikely

Independent action - Each firm can determine its own pricing policy without considering the possible reactions of rival firms

Product differentiation - Variations of particular product

Product attributes

Service

Location

Brand names + packaging

Some control over product prices

Easy entry + exit

Few economies of scale

Low capital requirements

Non-price competition - Product differentiation + advertising

Four firm concentration ratio - Ratio of the output (sales) of the four largest firms in an industry relative to total industry sales

Very low in purely competitive industries

Herfindahl index - Sum of the squared percentage market shares of all firms in the industry

Important to assess oligopolistic industries

Lower index → Greater chance of being competitive

Monopolistic competition’s demand curve

Highly elastic

No perfect product substitutes

Price elasticity depends on # of rivals + degree of product differentiation

Short run

Produces where MR = MC

May incur loss in short run

Long run

Only normal profit (break even)

Economic profits → Firms enter industry → Quantity increases → Economic profit decreases

Economic losses → Firms leave industry → Quantity decreases → Economic profit increases

Complications

Product differentiation can prevent duplication

In reality, entry is not as free

Efficiency

Neither productive nor allocative efficiency

Average total cost slightly higher than optimal

P > MC → Underallocation of resources

Excess capacity - Plant and equipment that are underused because firms are producing less than the minimum-ATC output

Product differentiation

Stay ahead of competitors

Provides more range to consumers

Trade-off b/w consumer choice + productive efficiency

Oligopoly - Market dominated by a few large producers of a homogeneous or differentiated product

3-5 firms

Homogeneous oligopoly - Standardized products

Differentiated oligopoly - Differentiated products

Strategic behavior - Self-interested behavior that takes into account reactions of others

Mutual interdependence - A situation in which each firm’s profit depends not entirely on its own price and sales strategies but also on those of the other firms

Entry barriers

Economies of scale

Large capital expenditures

Ownership + control of raw resources

Merge 2 competing firms → Increase market share + achieve greater economies of scale + greater monopoly power

Shortcomings of concentration ratios

Localized markets

Interindustry competition - Competition b/w 2 products associated w/ different industries

Import competition - Competition b/w foreign products

Game theory - Study of how people behave in strategic situations

Payoff matrix shows payoff to each firm resulting from different combinations of strategies

Collusion - Cooperation w/ rivals rather than work competitively/independently

Incentive to cheat - Cheating on collusive agreement to increase own profit

3 oligopoly models

(1) the kinked-demand curve, (2) collusive pricing, and (3) price leadership

Why isn’t there only a single model?

Diversity of oligopolies - Oligopoly encompasses a greater range and diversity of market situations than do other market structures

Complications of interdependence - The mutual interdependence of oligopolistic firms complicates matters significantly

Kinked demand curve - Demand is highly elastic above the going price P0 but much less elastic or even inelastic below that price

Rivals can either match price changes or ignore price changes

Prices stable in non-collusive oligopolistic industries

Even if costs change significantly, may not need to change price

Price war - Successive and continuous rounds of price cuts by rivals as they attempt to maintain their market shares

Cartels + other collusion

Cartel - A group of producers that typically creates a formal written agreement specifying how much each member will produce and charge

Obstacles to collusion

Demand + cost differences - When oligopolists face different costs and demand curves, it is difficult for them to agree on a price

Number of firms - Other things equal, the larger the number of firms, the more difficult it is to create a cartel or some other form of price collusion

Cheating - Collusive oligopolists are tempted to engage in secret price cutting to increase sales and profit

Long-lasting recession - Slumping markets increase average total cost

Potential entry of new firms - The greater prices and profits that result from collusion may attract new entrants, including foreign firms

Anti-trust law - U.S. antitrust laws prohibit cartels and price-fixing collusion

Price leadership - The dominant firm initiates price changes and all other firms more or less automatically follow the leader

Infrequent price changes

Communications of price changes

Limit pricing

Oligopoly + advertising

Product development + advertising less easily duplicated than price cuts

Positive effects

Diminishes monopoly power

Lowers consumers’ search costs

More economic efficiency

Negative effects

No info about price or quality

Based on misleading claims

Establishes brand loyalty + monopoly power

Oligopoly + efficiency

Neither productive nor allocative efficiency

No regulation of loophole monopoly power

Knowt

Knowt